Welcome to our ‘Fund in Focus’ series where we profile our member funds, underscore their investment philosophy, and highlight some of their interesting work. Today we speak to Nitin Sharma who joined Antler two years ago. While India possesses boundless opportunities as a growing economy, the gaps persist, especially at the seed and pre-seed stage. It is this needs gap which

wants to address by bringing best global practices at the idea stage and support impact enterprises of tomorrow.

FUND IN FOCUS: Antler Bets Big on Founders, Aims to Build NextGen successful companies in India

Nitin Sharma, Partner, Antler

1. What is the investment strategy of Antler for a diverse market like India?

As India’s early-stage ecosystem matures, it’s time for an institutional platform at the pre-seed stage to help founders build global-ready unicorns. That’s where Antler India comes in.

Antler India fills two critical gaps in the expanding Indian startup ecosystem. Firstly, it is a rare global institutional fund focused on the pre-seed stage in India, with proprietary platforms designed to support founders at the earliest stages (even pre-idea). We believe the maximum opportunity for impact and investment alpha is in creating new companies, not just chasing deals.

Secondly, it particularly serves founders “building in India, for the world”, which we believe is a big trend that will play out. Globally, Antler is the world’s fastest-growing early-stage platform, with a founding team consisting of operators and early investors in companies like Spotify, Grab, Tokopedia, Lazard’s and Zalora. The India fund is being built by an operator-investor combination of Rajiv Srivatsa (co-founder, Urban Ladder) and Nitin Sharma (India & US VC for 10+ years). Besides the two GPs, most of our India team leaders have also been founders themselves.

As day zero investors, we are in the business of facilitating company creation from ground zero over chasing deal flows, which in essence sets us apart and helps us reach out to a broad base of both aspiring and early-stage founders. We have 3 distinct offerings for the early-stage founder:

Antler India Residency (AIR) Program for the pre-team founder

Antler India Pre-Seed Platform for the founder with a ready team

The Antler India Fellowship (AIF) for the college founder

Across these programs, we take contrarian bets in new areas of innovation like climate tech, web 3.0, mental health, AI, vertical SaaS and others. The goal is to incubate ideas across domains and take true venture capital bets on Indian founders and back them with the might of the world's largest decentralized VC firm with a global presence across 25 cities and 600+ startups.

2. In India, there is a distinct funding gap at pre-seed and seed levels. Angel investors and micro-VCs are deeply involved in early-stage investing. As Antler India is an early-stage investor, what is your method in identifying noteworthy ideas and businesses?

Antler is the world’s largest pre-seed platform with a presence in India. This gives us a unique insight into the minds of early-stage founders across the world and then apply them to India. We saw 25,000+ founders apply to us over the first 20 months of operations in India, making us the largest pre-seed funnel in the country. This continues to give us a unique window into emerging technology trends and insights into various sectors. The applications are processed by an in-house team that leverages subject matter expertise to help source potential founders.

Parallelly, we have a unique platform in the form of Antler India Residency, where we work closely with founders over a period of 4-5 months and help them get from idea to team to funding. When you are investing in the early stages, it's hard to get a good understanding of the people unless you spend quality time with them. That's where a lot of the magic happens. Because spotless integrity, big ambition, and solid work ethic really shine through over a period of several months versus in a couple of pitch meetings. At Antler, we get to know all our founders as people, colleagues, and friends—which makes us very comfortable backing them.

Recently we have also started to partner with colleges in India for the Antler India Fellowship. From the inaugural program in which students from over 700 colleges participated, we have funded 3 startups. Our method stands out from any other pre-seed/early-stage investor in India both in terms of the overall breadth of reach and depth of the selection process.

In addition, we are obsessed with futuristic themes where we believe giant global companies will be built from India, and where we have significant investing or operating experience. We take a very long view and do not mind being ahead of the curve.

3. What's your take on the Indian emerging tech space with Metaverse, Web3, Crypto, climate-tech etc.? How, according to you, is frontier technology poised to disrupt enterprise tech space?

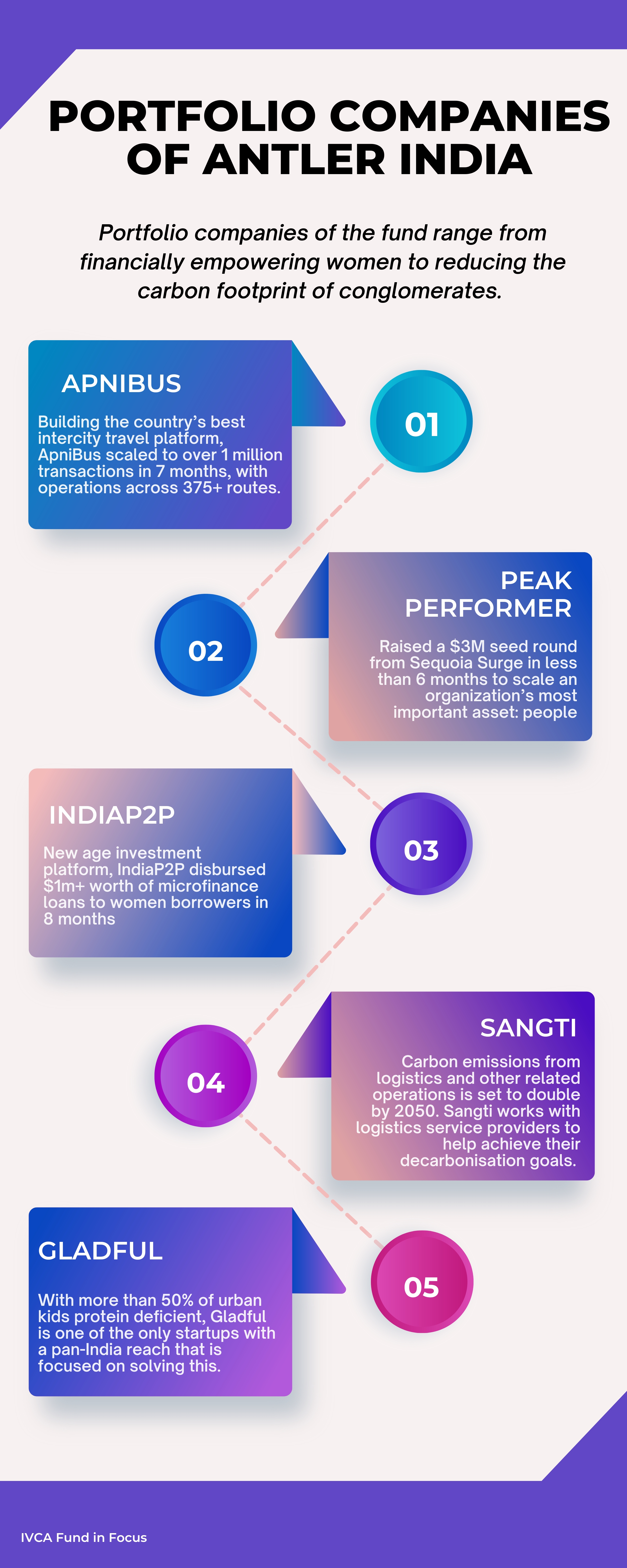

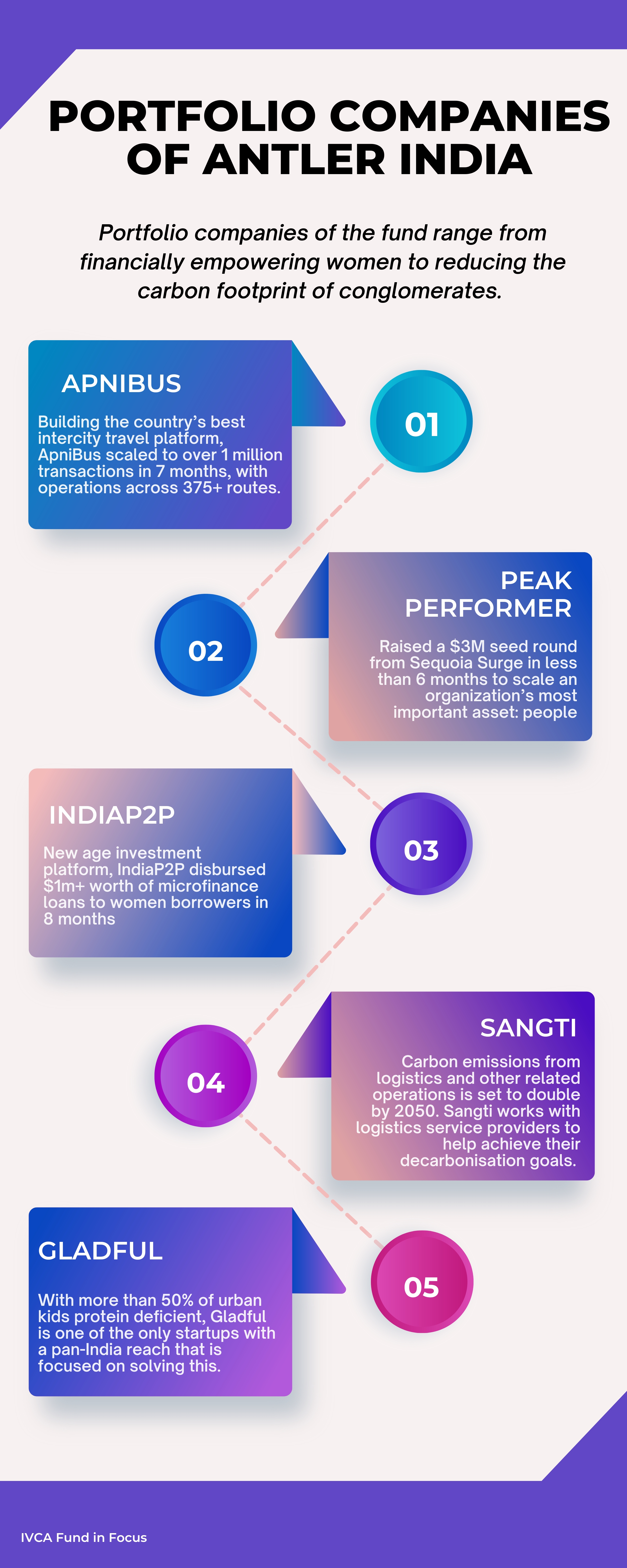

We are extremely positive and bullish on India’s emerging tech space in areas like metaverse, Web3, crypto, and climate tech. We have made investments in each of them, with Juno Finance, Flint, PYOR and 5 others in Web3, Invact in metaverse, and Sangti in climate tech.

Indian teams in these spaces will build for the world from India. Indian founders, engineering and marketing talent are uniquely positioned to take advantage of the overall trend of Indian firms moving from offering cost-effective services to building world-class products and platforms.

Add to this Antler’s global presence that allows our startups to leverage offices and resources across the world to test, validate, and scale global products.

Frontier technology like AI and others can be enablers or death knells for enterprises that don’t adopt them. Startups that help build solutions for enterprises to adopt new technology paradigms like AI stand to gain a lot from this evolution. This is why we have backed startups like Hexo AI, which are at the intersection of cutting-edge tech, enterprise know-how, and Indian founders with a global mindset.

4. What is the philosophy of Antler being a people-centric investment firm?

Being a founder-first VC firm, Antler is deeply invested in the individual. At these early stages, where there is little else to go by, we are in the business of taking founder bets and enabling new team formation. We strongly believe that enabling early-stage founders and providing them with the right conditions to succeed will be the key to building the next generation of successful companies. We believe that in order to make progress inevitable, it has to start with the people.

5. What are your thoughts on the 'India Opportunity' today? Which are the most important growth drivers for the economy in the next two decades?

We are excited about 4 major themes that will define the "India Opportunity" for us. Many of these call for bold, more global thinking from Day 1.

Building on the world's best Digital Public Goods (DPG)

India's putting together the world's most widely adopted DPGs that commoditize key aspects of commerce, payments, and lending with UPI, OECN, ONDC, India Stack and Aadhaar. These DPGs will be powerful catalysts driving economic growth going forward.

The rise of new global SaaS

Companies like Browserstack, Innovaccer, Postman and SignEasy have emerged as category leaders by 'building in India for the globe'. This trend will accelerate due to a maturing SaaS ecosystem and the emergence of the 'building in India for the globe' playbook.

Climate change solutions

India is the world’s largest fast-growing economy, and the rate of per capita energy consumption will only increase. This opens opportunities for climate tech and sustainability startups to enable every individual, organization and enterprise to become carbon-neutral and efficient over the next few decades.

Building global Web 3.0 infrastructure

India is moving from services to products to platforms esp. in areas like Web3. Founders are rapidly acquiring skills and thinking big to create global platforms/ecosystems and communities. With projects like Polygon being built in India for the world's blockchain developers to build on, India will be one of the world's best builders of Web 3.0 infrastructure.

6. Any advice to budding entrepreneurs?

Given the current economic climate, we feel this is one of the best times for exceptional would-be founders to take the entrepreneurial leap if they are truly driven by a problem or mission.

Founders who start now have the advantage of building product and customer-first ventures with fewer distractions and rivals who have inferior products but superior marketing budgets.

1 out of 3 Fortune 500 companies started in a recession and that is because constraints also enable creativity and grit. So, our advice would be that if you are a budding entrepreneur, take the leap and give us a call!