#TheContext

China + 1: How is India Transforming into a Global Manufacturing Powerhouse

Since the dawn of time, economies have grown alongside manufacturing revolutions — such as the United States (U.S.) during the 1970s, Japan during the 1910s, and even Germany during the 1900s.

Today, China dominates global manufacturing with a ~30% share, followed by the U.S. at ~16%, Japan at ~7%, and Germany at ~5%. However, China grapples with weakening political relations and logistical challenges, the U.S. with labour shortages and higher costs, and Germany’s supremacy witnessing challenges, thus, creating opportunities for emerging players such as India. This article explores the evolving landscape of global manufacturing and India's rising role as a beneficiary of this evolving landscape.

A. How is Germany losing supremacy over manufacturing & can India be a beneficiary?

For decades, Germany had been an industrial powerhouse (accounting for ~23% of its GDP) with nearly 50% of its economy running on exports. Germany has always been an energy dependent economy, with industries such as chemicals, pharma, glass, metals and paper contributing to 20% of its manufacturing industry (2022).

However, Germany's economic output fell 0.3% in 2023 with energy-intensive production down 11% - driven by 3 key factors – higher energy prices, Germany’s net-zero energy policy, and a slowdown in China (a key trade partner to Germany).

Russia contributes ~55% of Germany’s natural gas imports; Russia’s invasion of Ukraine and the destruction of the Nord Stream (a connecting natural gas pipeline), ended Germany’s business model that was based on manufacturing using cheap energy imports and industrial exports.

Another factor has been Germany’s dependence on China’s demand. After peaking in 2022, German exports to China fell by 9% in 2023. This was led by a slowdown in China and a change in the competitive landscape (pressure from local competition in China due to their policies favouring domestic firms). Thus, in July 2023, the German government published a ‘China + 1’ strategy, advocating for economic diversification away from China. Research from the German Chamber of Commerce in China suggests that nearly 60% of companies surveyed said they would be investing more in India, similarly, ~40% for Vietnam, 30% for Thailand, ~25% for Malaysia and 20% for Singapore

Research from KPMG suggests that India is becoming an important cornerstone of Germany’s de-risking strategy across purchase, production and also in R&D. By 2028, ~25% of German companies want to use India for their R&D and 53% want to produce in India.

B. Transformation of the Indian manufacturing driven by strong international relations and geographical advantage

China + 1 is not just a buzz word – there is actual evidence and interest towards India, Mexico, Vietnam, Thailand and Indonesia.

Research from BCG suggests that more than 90% of the North American manufacturers surveyed have relocated production or part of their supply base from China to other countries over the last 5 years and is expected to continue over the next 5 years. Moreover, manufacturers are willing to give up more than 2% in gross margins to operate with shorter lead times and make their supply chains resilient.

Companies are already shifting operations to India - according to market research firm OnePoll, ~60% of 500 executive-level U.S. managers surveyed said they would pick India over China if both could manufacture the same materials.

The value of announced U.S. and European greenfield investment into India shot up by ~US $65B (400%) between 2021 and 2022, while investment into China dropped to less than $20B in 2022, from a peak of $120B in 2018.

Ties between American companies and India, as a manufacturing and supply chain partner, are getting deeper on the back of political friendliness of the US Secretary of Commerce with Asian countries.

- Boeing currently has 5,000 employees and has invested $1B with 300 suppliers in its supply chain in India. Boeing is not only selling planes to Indian carriers but also making several components along with the Tata group in their 14000 sq. m manufacturing facility in Telangana. They have also announced investments in setting up its ‘Global Support Center and Logistics Center’ in India.

- Apple and its suppliers are aiming to build more than 50M iPhones in India annually within the next 2-3 years. If the plans are achieved, India would account for 25% of global iPhone production from the current ~7% in FY 23. Japanese company TDK, a supplier of cells to Apple, is setting up a 180-acre facility in Manesar, Haryana to build cells for batteries used in the iPhones.

- Google has directed suppliers to commence production of its Pixel 8 smartphones in India by establishing a factory in South India.

- Tesla has also been talking with the government to finalise a package of incentives that could include lower import duties for EVs in return for a $2B investment in a proposed EV facility in India.

- Walmart has a target of sourcing $10B worth of goods from India annually by 2027 and is already exporting $3B worth of goods.

B1. Measures by the Government

The government has taken a slew of measures to make India an attractive and competitive destination for manufacturing and exports.

- PLI (Production Linked Incentive Schemes): This has been a game-changer as it has helped increase manufacturing activity in the country across 14 sectors and has attracted investments of over Rs 1 lakh crore as of 2023, resulting in production and sales amounting to over Rs 8.5 lakh crore.

- FTAs (Free Trade Agreements): India has signed 13 FTAs with 22 countries with the key ones being Mauritius, UAE and Australia and currently engaged in negotiations with multiple countries including Oman, the UK, the EU, Canada, and various Indo-Pacific Economic Framework (IPEF) partner countries.

- Liberalisation of FDI norms: The government has liberalized FDI policies allowing 100% investment in many sectors such as pharmaceuticals (greenfield & brownfield investments), defence manufacturing, e-commerce services and food processing.

- Gati Shakti: The Rs 100 lakh crore Gati Shakti project is helping expand the logistical network in India at a faster pace and improve India’s multi-modal connectivity. Until now, ~Rs 12 lakh crore worth of projects have already been sanctioned.

B2. India's Export Surge: Breaking Down the Numbers

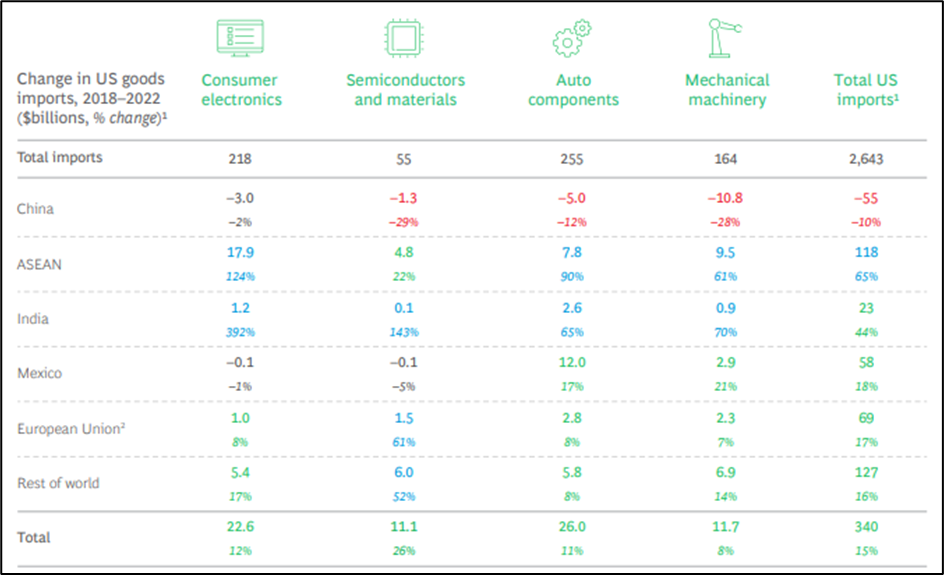

While US goods imported from China declined by 10% from 2018 - 2022 , they rose by 44% from India (by $23B), 18% from Mexico, and 65% from other ASEAN countries. Chinese exports to US for semiconductors decreased by 29% from China from 2018 - 2022 but increased by 143% for India. Similarly, for auto components, Chinese exports witnessed a 12% decrease, but Indian exports saw a 65% increase.

B3. India's Unique Edge in Global Manufacturing

While India, Mexico and other SE Asia countries (Vietnam, Thailand, Indonesia etc.) are emerging as future export manufacturing countries, offering competitive cost structures and abundant labour; India stands out with its large domestic market, helping companies with cheaper production costs + access to additional demand.

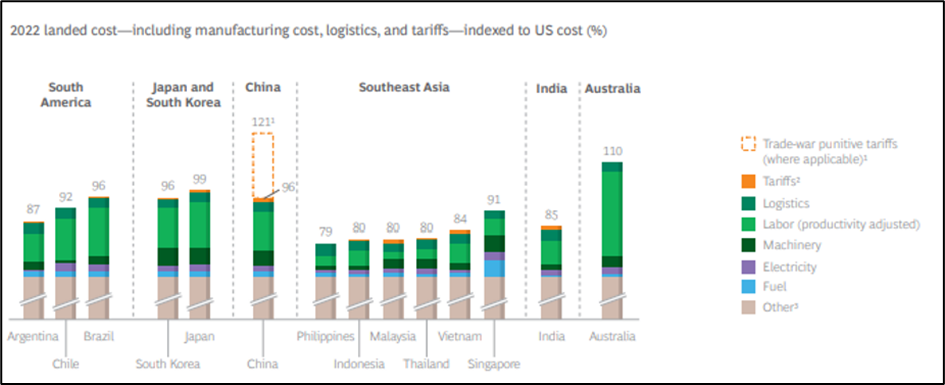

Moreover, India provides a higher advantage in direct manufacturing costs (15% lower than the US, compared to China’s 4%. Additionally, some Chinese goods are subject to 21% higher on the back of trade war punitive tariffs.

In conclusion, as global economic dynamics shift, India is emerging as a viable alternative to traditional manufacturing powerhouses such as Germany and China. India's attractive cost structures, supportive government policies, large domestic market and competitive manufacturing costs add to the 'China + 1' strategy making India a promising destination for global manufacturing hub.

#TheContext by IVCA – features opinion makers from the alternate investing industry with strong focus on India as an investment destination. Watch this space for new announcements in the sector, viewpoints on investment themes, emerging trends, economic reports, analysis and latest industry insights.