#TheContext

Exploring the 'Missing-Link': The India Opportunity for Growth Stage Impact Funds

Ramraj Pai

The impact investing market in India has experienced significant growth in recent years. The analysis by Impact Investors Council (IIC) shows that equity investments into Indian impact enterprises reached a record high of ~$7 Bn in 2021, with more than $13 Bn invested over the past three years.

As the impact sector expands and impact enterprises grow, there is an urgent need for growth-stage impact funds focused on India to support the transition of these enterprises beyond early-stage funding. The existence of such funds is vital to maintain the development and maturity of India's impact investing ecosystem, given the emergence of the following themes:

The demand for impact capital in growth stage (and beyond) deals has increased significantly (80%) from 2017-2021, relative to a 40% increase in total impact deal flow. This shows that a growing number of Indian impact enterprises are scaling up, leading to stronger investment demand and a unique risk-return-impact profile suitable for growth-stage funds.

On the supply side, Large LPs globally and in India are showing an increased interest in private sector opportunities with strong ESG and impact credentials. Investing in such opportunities can provide a strong foundation for scalable growth with returns, creating a strong business case for combining financial and social impact.

It is important for impact enterprises to stay focused on their core impact thesis as they mature and not shift their business model to prioritize profit over social impact. Growth stage impact funds can help prevent mission drift by incentivizing impact enterprises to remain socially responsible.

Absence of impact funding in late-stage, higher-ticket deals represents an untapped opportunity for impact investors

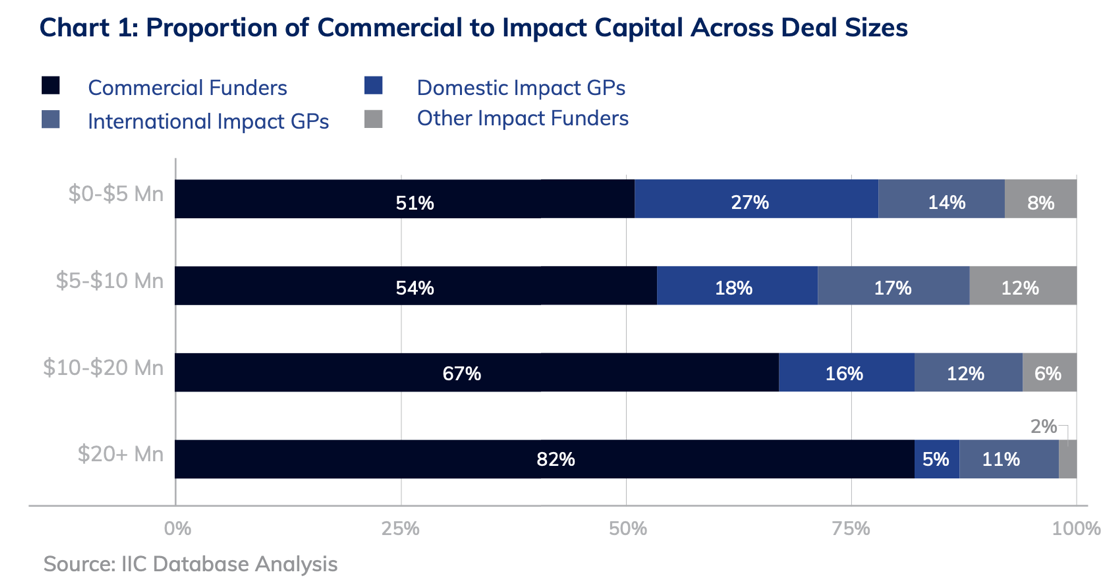

IIC analysis indicates an untapped opportunity for impact funders in larger deals in later stages. Impact funders contribute less as deal size increases, with only 20% in the largest deals. Impact investing is becoming more mainstream with growing interest from traditional asset managers and capital providers. This presents opportunities for larger impact and ESG funds to participate in larger investments and help social enterprises scale up (refer Chart 1)

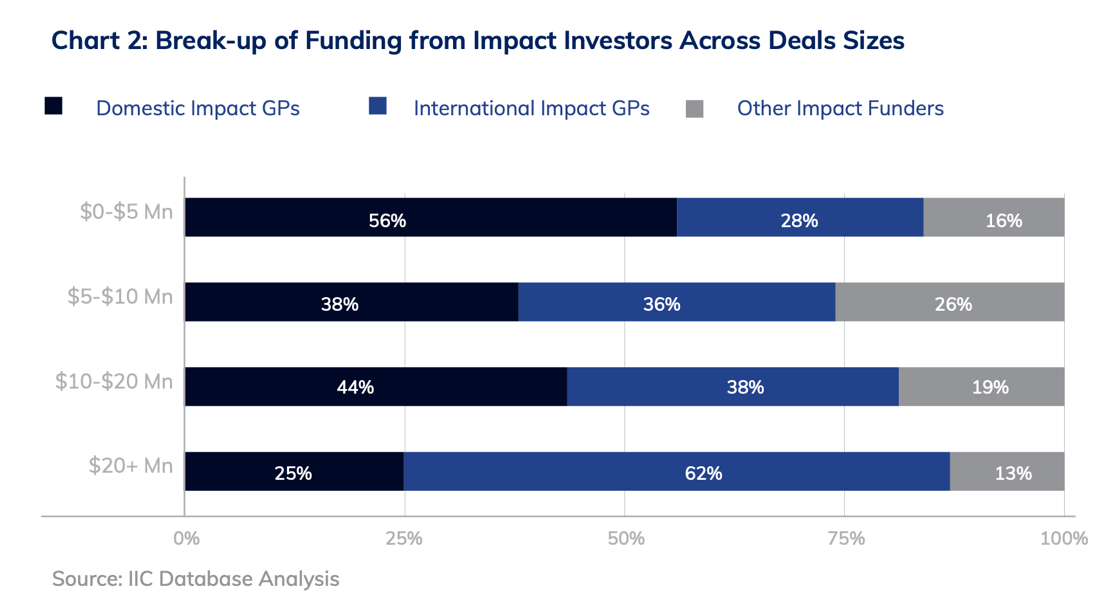

Domestic Impact GPs dominate smaller ticket, early-stage deals while open spaces remain in late-stage impact funding

An analysis of impact investor funding shows that India-based impact GPs are dominant in small early-stage deals but have a limited presence in larger later-stage deals, making up only 25% of invested capital (refer Chart 2). The limited funding for later-stage deals comes from international impact GPs, DFIs, and others.

The trend reflects the limitations of Indian impact GPs structured as early-stage venture platforms, leading to a funding gap for growth-stage social enterprises, which are partially filled by commercial investors. Growth-stage social enterprises offer a more attractive investment opportunity due to proven impact and financial return potential, making them attractive for LPs, international impact funds, and India-based growth-stage impact funds.

Conclusion

The Indian equity impact investing market is expected to grow as the country needs to spend ~$170 Bn annually to achieve the Sustainable Development Goals by 2030. To maximize the potential of India's social innovation, it is important to bring in asset managers capable of financing impact deals over $20 million, offering opportunities for larger impact and ESG funds to invest in higher-value deals.

To read more, download the report here

#TheContext by IVCA – features opinion makers from the alternate investing industry with strong focus on India as investment destination. Watch this space for viewpoints on investment themes, emerging trends, economic analysis and latest industry insights.